Simplifying Transactions for Convenience

Small amount payments have become increasingly popular in today’s digital world, where microtransactions, contactless payments, and app-based purchases are common. They represent transactions involving small sums of money, often under a few dollars, used for everyday purchases like coffee, snacks, or public transportation. The convenience of small payments allows consumers to complete transactions quickly and efficiently, without the hassle of carrying cash or handling change. This streamlined approach benefits both consumers and businesses by reducing checkout times and enabling seamless purchases for low-cost items.

Enhancing Financial Flexibility for Consumers

For many consumers, small amount payments offer a level of financial flexibility that large transactions simply cannot. These microtransactions allow people to control their spending more precisely, making it easier to stick to budgets or allocate funds on a daily or weekly basis. By using digital wallets or payment apps for these small purchases, individuals can monitor their expenses in real-time, providing them with better financial awareness and control. This flexibility is particularly beneficial for young people, students, or those on fixed incomes, as it helps them avoid overspending while still enjoying small indulgences.

Boosting Business Revenue with Microtransactions

Small amount payments offer an excellent opportunity for businesses to increase revenue, especially in industries that rely on high transaction volumes rather than high-value purchases. Coffee shops, fast-food restaurants, vending machines, and even online content providers can benefit from allowing customers to make small payments easily and quickly. These small payments can add up significantly over time, creating a steady revenue stream that benefits businesses. Moreover, offering the option for small, quick transactions can improve customer satisfaction and loyalty, as customers appreciate the flexibility and ease of making these minor purchases without lengthy payment processes.

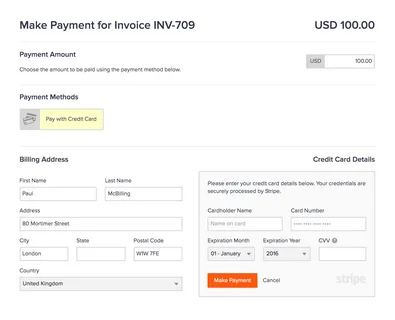

Leveraging Technology for Secure Small Payments

The rise of small amount payments has been facilitated by advancements in technology, which have made these transactions more secure and accessible. Digital wallets, mobile payment platforms, and contactless payment methods use encryption and authentication measures to protect users’ financial information, ensuring that even small transactions are safe from fraud. Additionally, the technology behind these payment methods makes them more reliable, allowing users to make transactions anywhere, anytime. As these technologies continue to develop, small amount payments will likely become even more secure, accessible, and convenient, benefiting both consumers and businesses alike.문화상품권카드